On Thursday 16th June, EMEA held and organised the second INVESTMED workshop on Access to Finance titled “Sustainable Finance and Strategies for Sustainable Entrepreneurship”.

The workshop explored strategies for sustainable finance for start-ups, such as the importance of environmental, social and governance factors, and the value of joining a network of entrepreneurs and being aware of international support programmes, as well as the role of incubators in channeling entrepreneurs towards finance.

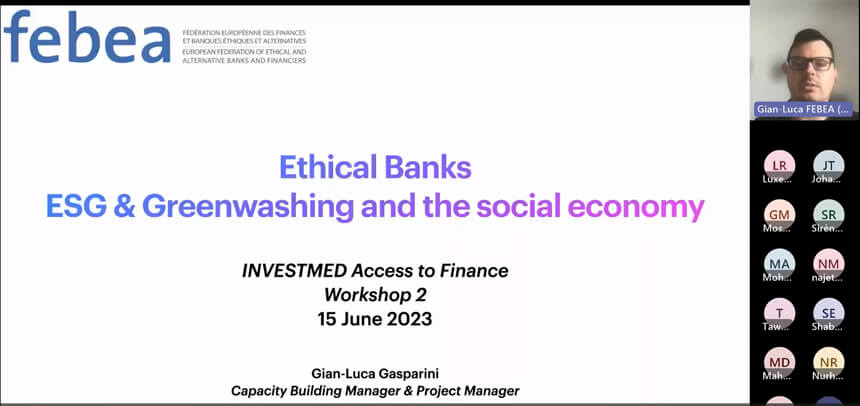

The first speaker, Gian-Luca Gasparini, Capacity Building Manager & Project Manager at FEBEA, the European Federation of Ethical and Alternative Banks and Financier Members who discussed the role of ethical and alternative banks when looking for funding for entrepreneurial projects. He emphasized the importance of Environmental, Social and Governance (ESG) factors in applying for a loan and how to ensure reporting stands out against cases of greenwashing.

Following Gian-Luca Gasparini and the role of ethical banks, we heard from Giorgio Monsangini, Team Leader – Green Entrepreneurship & Civil Society, MedWaves who presented the SwitchMed Programme. SwitchMed is aims at achieving a circular economy in the southern Mediterranean by changing the way goods and services are produced and consumed. On their platform and toolbox, there is a range of “access to finance” tools for entrepreneurs. He highlighted that there are many gaps in access to entrepreneurs but SwitchMed aims to bridge this gap and ensure that early stage startups have the funding they need to grow further.

The next speaker, Dr. Mohamed Abbas, Associate Director and Head of Business Incubators Program a Nile Preneurs, a Central Bank of Egypt Initiative based at Nile University, discussed the role an incubator plays in connecting entrepreneurs with financial actors such as credit guarantees and banks. He paid particular attention to the Egyptian ecosystem and how entrepreneurs can access these tools and services using incubators as the connecting entity.

Johanna von Toggenburg, Lebanon Country Manager at cewas Middle East – an incubator based working in the blue and green economies supporting ideation – incubation – acceleration and scale-up. They build enabling ecosystems, and offer technical assistance, and finance support. She highlighted that the most important thing for entrepreneurs to ensure when they apply for a loan from a bank is a solid revenue stream. She explained that grants are helpful in the beginning, but entrepreneurs must move on to other sources of finance and be “investment ready”.

The session closed with an extended Question and Answer session from the INVESTMED beneficiaries. One participant from Egypt raised the point that the funding sought generally does not cover salaries. Our experts confirmed that this is often the case given that many startups are high risk for investors. In order to gain a salary from the investors, this needs to be stated from the very beginning. However, it was highlighted that when in the ideation stage, the more effective methods of finance are grants or through approaches such as crowdfunding.

Another participant from Lebanon asked how she can know which source of finance is right for her startup. This is a common issue for entrepreneurs, however, tools through initiatives such as SwitchMed and incubation services are available to entrepreneurs as they channel them to the right sources of finance.

Finally, when asked if entrepreneurs should be looking internationally or nationally for funding, the response was that as a general rule, entrepreneurs should look for national sources of finance as there are often more opportunities and the investors are more confident navigating the local context and landscape. However, in some cases international sources may be of interest such as grants or impact investors.

The end of the question-and-answer session signalled the end of the informative workshop on sustainable finance and strategies for sustainable entrepreneurship. The next workshop will be held in July and will cover Credit Guarantee Schemes.