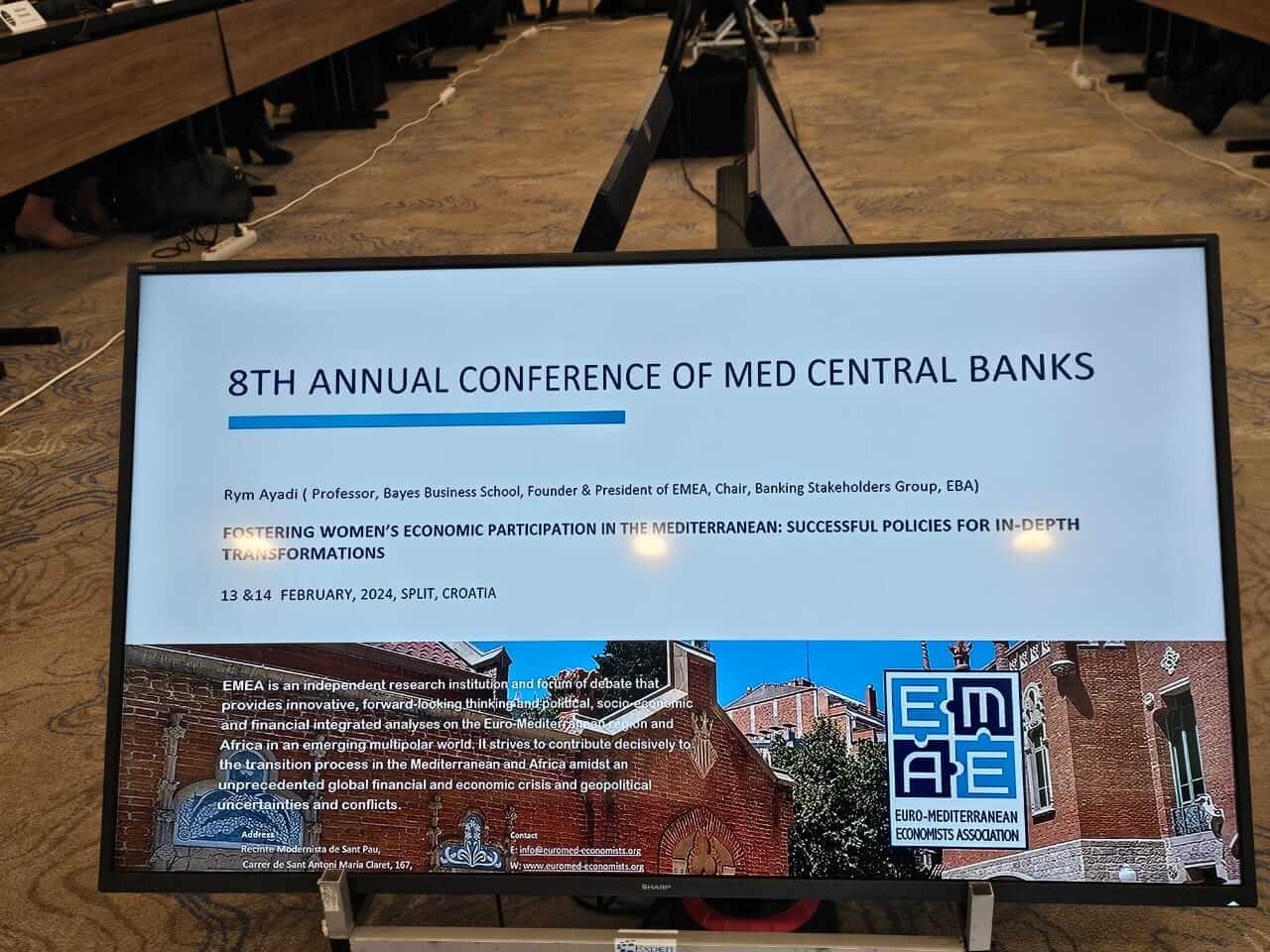

The President of EMEA, Prof. Rym Ayadi, Professor at the Bayes Business School, and Chair of the Banking Stakeholders Group (BSG) of the European Banking Authority (EBA), was one of the speakers at the VIII Mediterranean Central Banks Conference “Stay the Course in Turbulent Times: Old and New Challenges for Central Banks”. The event took place on 14 February 2024 in Split, Croatia, and it was organised by Banco de España, the Croatian National Bank, the European Institute of the Mediterranean (IEMed), the Organization for Economic Cooperation and Development (OECD), and the Union for the Mediterranean (UfM).

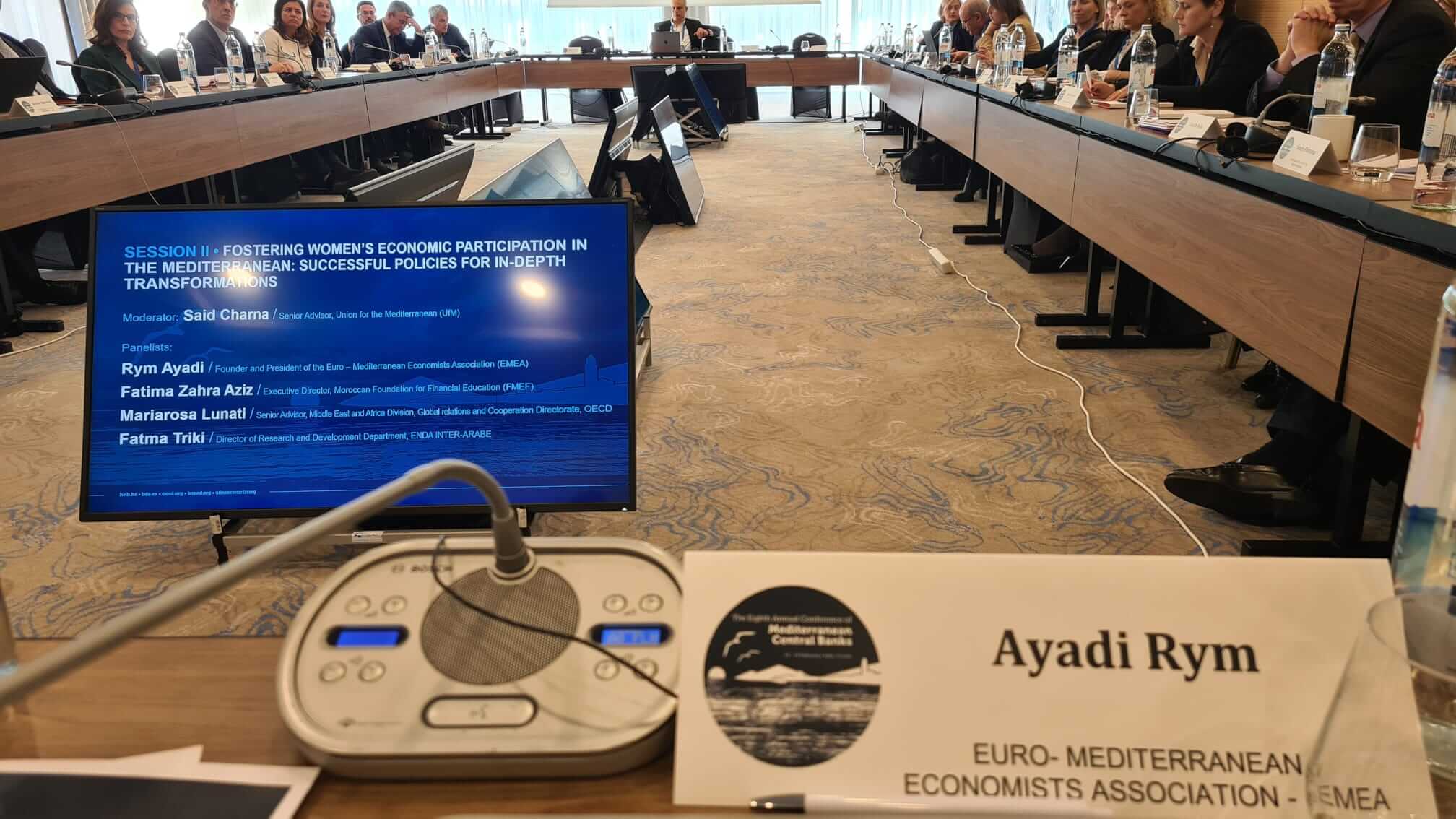

Prof Ayadi participated in the session “Fostering women’s economic participation in the Mediterranean: Successful policies for in-depth transformations”, In her intervention she underlined:

“Central banks can have a promoting role for financial inclusivity, designing policies and fostering environments that unlock financial access for women entrepreneurs. By championing regulatory reforms, supporting gender-sensitive credit schemes and guarantees, and endorsing fintech innovations, they illuminate the path for women to navigate financial landscapes with confidence and ambition. In doing so, central banks not only empower women but also catalyze broader economic resilience, diversity and social progress”.

The session was moderated by Said Charna – UfM, and included Fatima Zahra Aziz, Executive Director – Moroccan Foundation for Financial Education (FMEF), Mariarosa Lunati – Senior Advisor, Middle East and Africa Division, Global Relations and Cooperation Directorate, OECD, and Fatma Triki – Director of Research and Development Department, ENDA INTER-ARABE.

The panel explored various critical issues, such as identifying primary barriers that women encounter in achieving financial inclusion in the Mediterranean. Additionally, the discussion delved into successful strategies employed to overcome these barriers. The session also examined the potential of leveraging digital technologies and fintech solutions to enhance women’s access to finance in the region. Furthermore, participants considered the role that government policies, regulations, and financial institutions can play in promoting women’s financial inclusion. Lastly, the panel explored successful initiatives aimed at improving women’s financial literacy and analyzed their impact on economic independence and overall well-being.