On the 26th October, INVESTMED project partner, the Euro-Mediterranean Economists Association, held the final Access to Finance workshop, inviting entrepreneurs in the green, blue, and cultural and creative industries to connect with investors from Egypt, Lebanon and Tunisia. This was the final session in a series of 4 workshops with finance suppliers and experts to support the INVESTMED entrepreneurs with access to sustainable finance beyond the activities of the INVESTMED project.

The first speaker was Antoun Mouawad, VP at IM Fndgn, an entity that groups IM Ventures, a $38M program funded under USAID Lebanon Investment Initiative (LII), and IM Capital, a $20M program funded under USAID MENA Investment Initiative (MENA-II), discussed the investment landscape in the MENA region explaining that there is a real urgency to develop climate technologies. He explained that IM Fndng has launched a SoLR& Renewable Energy Fund worth $20M to finance up to 25 growth-stage businesses in Lebanon with sustainable business models and look to invest in efficient and renewable energies. He highlighted that VCs in the region are generally active in climate tech, and specialised business accelerators such as PepsiCo Greenhouse exist.

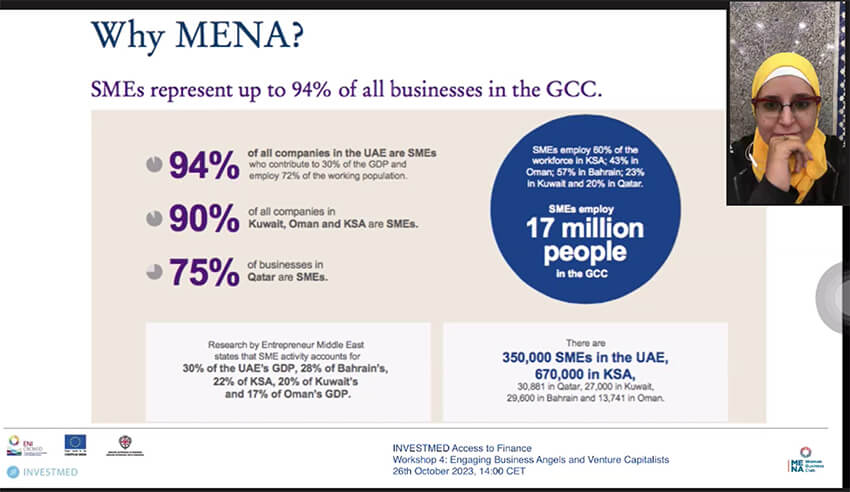

Following the regional presentation focusing on climate tech, we turned to Dr Ayah El Arief, Managing Director of the MENA Women’s Business Club, who gave her perspective on investing in the cultural and creative industries. As a start-up founder and CEO, she provided the INVESTMED entrepreneurs with solid and practical advice on investing. She gave a very positive view of the landscape in the MENA region. She explained that 94% of businesses are SMEs in the region, demonstrating its creativity and potential for growth. She also said that exports from the region were growing meaning there is an appetite for this creativity internationally, and competition is rising. In this landscape, the most important action MSMEs can take is networking to find the right investor for their company. Not all investors can be positive for your business, she said, so it’s crucial to match with someone who will support you grow in your business.

Dr. Arief also explained the landscape relating to Egypt specifically and highlighted that Egypt is very attractive for investors and has been growing as a market in recent years. This is partly due to increased governmental support which has led to the creation of hubs for innovation, co-working, and funding for attending events abroad. She also provided many examples of active investors in Egypt for participants to look to.

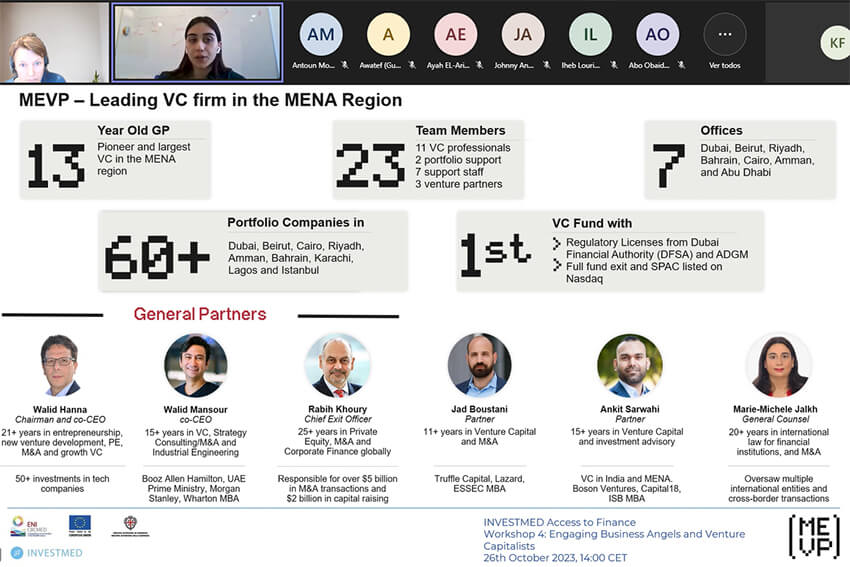

Turning to country perspectives, we were joined by Gaelle Yammine, Associate Director of Middle East Venture Partners (MEVP) who discussed the Lebanese market in depth and the work done at MEVP. They invest in technology startups in the GCC, and MENA and have had $1.6 billion in co-investments. They’ve been in the market for 13 years and invested in over 60 companies.

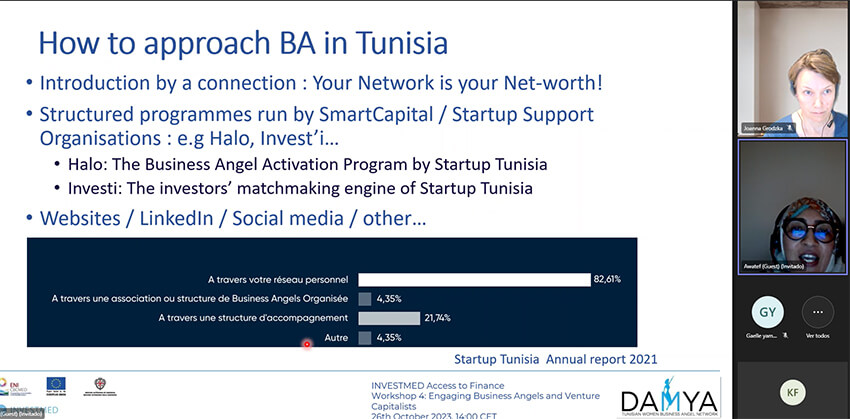

Presenting DAMYA, the Women Business Angel Network Tunisia, was Awatef Adalet, Senior Business Analyst in the energy sector. She explained that DAMYA has the aim of closing the gender gap in investing by looking at both the number of female investors and the number of female founders that close investment deals in Tunisia. They are a network of investors and connect with large firms such as Med Angels. Moving to the general landscape in Tunisia, she commented that 57% of the start-ups in Tunisia work on a B2B business model and of 129 investment operations venture capital takes the largest share with 39%, and business angels have just more than 12%.

The workshop ended with a question-and-answer session from the participants who were encouraged to present their own business and the barriers they face in order to gain expert insight from the speakers. This event served as excellent preparation for the INVESTMED subgrantees as they attend the final regional event in Tunisia at the end of November as they pitch to real investors.

The INVESTMED Project (InNoVativE Sustainable sTart-ups for the MEDiterranean) is co-funded by the European Union under the ENI CBC Mediterranean Sea Basin Programme 2014-2020. INVESTMED has a duration of 30 months, with a total budget of €3.8 Million, of which €3.4 Million (90%) is funded by ENI CBC MED. It has 8 partners from Tunisia, Spain, Lebanon, Greece, Egypt, and Italy:

- Union of Mediterranean Confederations of Enterprises, BUSINESSMED (TU)

- Euro-Mediterranean Economists Association, EMEA (ES)

- European Institute of the Mediterranean, IEMed (ES)

- Beyond Group / Irada Group S.A.L, BRD (LE)

- Institute of Entrepreneurship Development, IED (GR)

- Libera Università Maria SS. Assunta, LUMSA (IT)

- Confederation of Egyptian European Business Associations, CEEBA (EG)

- Spanish Chamber of Commerce, CCE (ES)